InvoCare, which is listed on the Australian Securities Exchange (IVC:ASX), is Australia’s largest provider of funeral, cemetery, crematoria and related services. It currently operates over 290 funeral locations and 16 cemeteries and crematoria, across Australia, New Zealand and Singapore.

InvoCare, owns well known funeral home brands such as White Lady Funerals, Guardian Funerals and Simplicity Funerals, and has control of more than 34% of the Australian funeral market. It also owns related services and products HeavenAddress; LifeArt coffins; Guardian Funeral Plans, MyGriefAssist, MyMemorial and Funeral Planner.

So if you’ve ever searched for a funeral director or related services online, you’ve probably come across one of their funeral brands. Although the names of funeral homes and services are well known, the revenues and profits from them flow to corporate shareholders.

Historical background

InvoCare was created in 2001 as part of a divestment by Service Corporation International who sold an 80% stake of their Australian funeral division to a consortium led by Macquarie Bank. In 2003 InvoCare was floated on the Australian Securities Exchange with shares debuted at $1.89, a 2 per cent premium on their issue price of $1.85. At the time of the listing, InvoCare conducted 21 per cent of the nation’s funerals and owned the chains Simplicity and White Lady Funerals.

The InvoCare Business model

InvoCare’s business model has traditionally been based upon acquisitions of existing funeral businesses in the major capitals of Australia and above average sales to drive high single digit Earnings per share (EPS) growth. This strategy has delivered InvoCare investors an average return of 16% since listing in 2003.

Deaths, Sales and and More Funerals

InvoCare’s Annual General Meeting will be held on Tuesday 14 May 2019 in the offices of PricewaterhouseCoopers, One International Towers Sydney, Watermans Quay, Barangaroo, Sydney, New South Wales.

The following is a snapshot from InvoCare’s Annual Report 2018 on their business performance and their growth strategies (Protect & Grow and Regional Acquisitions).

Need More People To Die

The number of deaths continues to be a significant driver of InvoCare’s performance. Overall, numbers of deaths in InvoCare’s core markets decreased by approximately 3.1% in Australia compared to 2017.

Increased Market Share

Operational changes to traditional brands, in conjunction with the acquisitions saw InvoCare’s market share increase of 40bps.

Lower Funeral Sales

Australian comparable funeral sales decreased 4.7% or $14.8 million to $300.1 million (2017: $314.8 million). InvoCare reported to the ASX in October 2018 that a mild winter and benign flu season would result in lower deaths and lead to lower volumes and ability to achieve average price year on year increases.

More Funeral Cases

In 2018, InvoCare invested $70.6 million to acquire 11 funeral businesses in Australia and New Zealand, adding over 3,500 funeral cases, 1,200 cremation cases and around $26 million in revenue per annum.

More Money from Prepaid Funerals

In 2018, total prepaid funeral funds under InvoCare management increased by 3.2% to $563.6 million.

2019 Outlook: More deaths, More acquisitions, More profits

The 2019 outlook for InvoCare shareholders is more deaths, more acquisitions and more profits. In particular:

- The expectation for 2019 is for the number of deaths to increase and return in line with the positive longer term trend

- Improved trading in the Australian funeral business in Q4 2018 and January 2019 is pointing towards the market normalising

- InvoCare will provide a trading update and outlook for 2019 at the AGM in May

- InvoCare is well positioned to meet the challenge of changing customer preferences through its investment in the Protect & Grow and regional acquisition strategies

- InvoCare remains confident that this investment will deliver sustainable double digit operating EPS growth in the medium to longer term.

A full copy of the Annual Report 2018 can be found at www.invocare.com.au.

Related Articles

InvoCare Has Made A Killing For Investors: Is It Time To Say Goodbye

Australia’s Largest Funeral Company raises $65 Million To Grow More (And More) Market Share

Are InvoCare shares on shaky ground

Australia’s Largest Funeral Company Needs More People To Die This Year

Are You Comparing Funeral Prices From The Same Company

The Elephant, The Mouse and The Funeral

InvoCare’s Growth At Expense Of Consumers

Learn more about funerals in Australia

Get your FREE Book: ‘What Kind of Funeral’

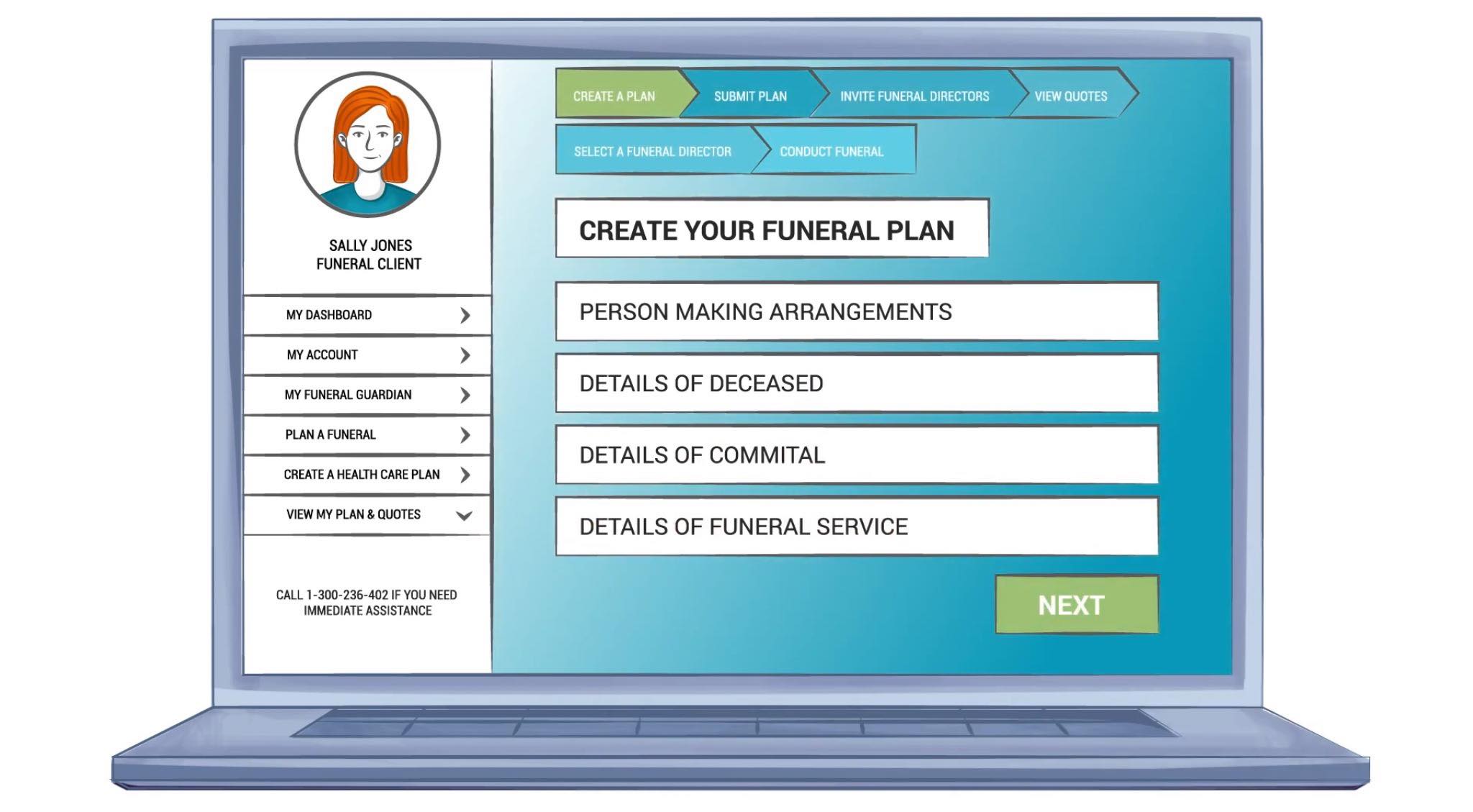

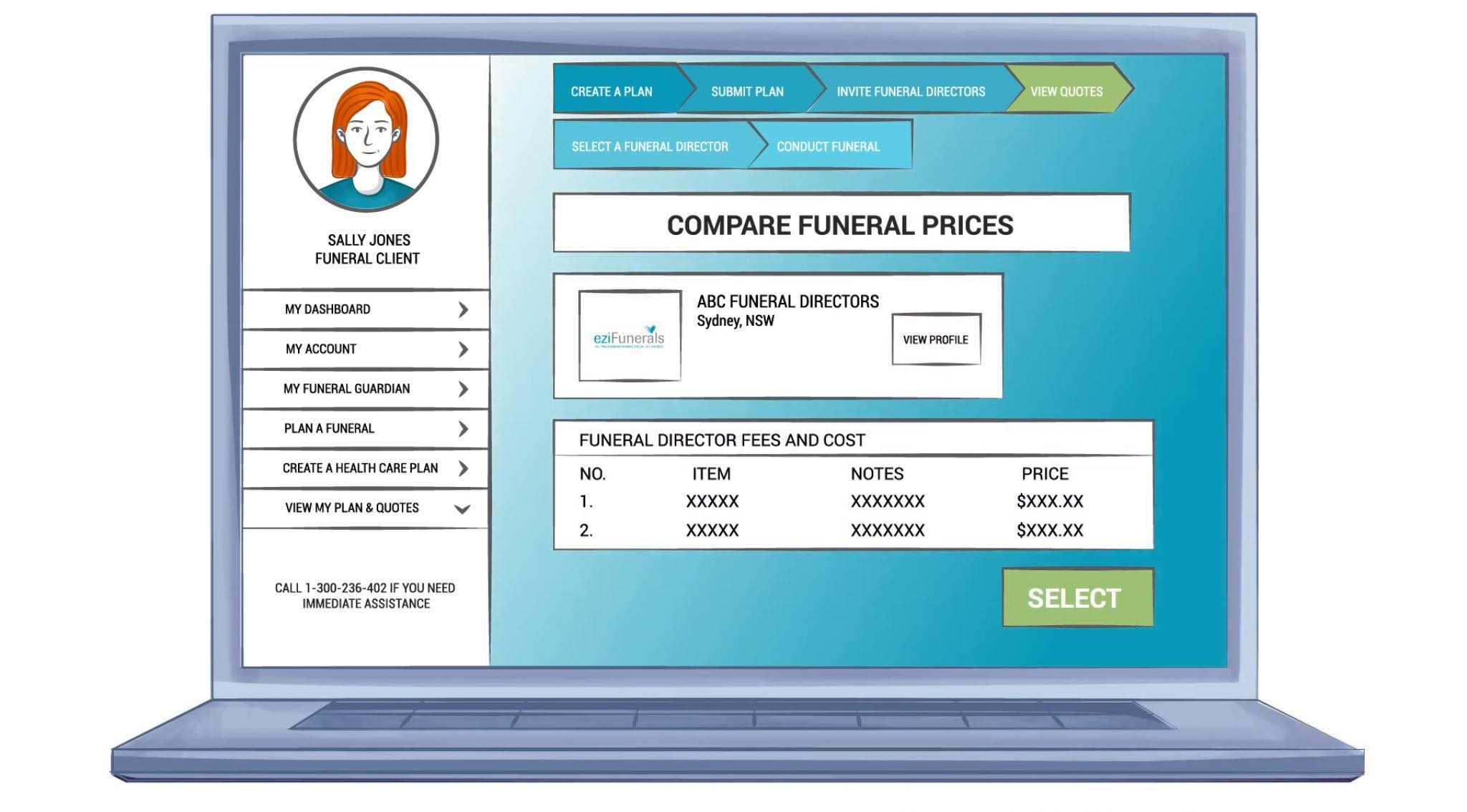

About eziFunerals

eziFunerals supports individuals and families cope with end of life decisions, death and funerals. We are an independent, Australian-owned and operated company, and are not a subsidiary of any other corporation. We do not conduct funerals and are not part of any other funeral company.