Propel Funeral Partners Ltd (ASX: PFP) has raised the interest of the ACCC with its latest acquisition of the largest funeral operator on Queensland’s Sunshine Coast.

In a race to compete with InvoCare (ASX: IVC), Propel Funeral Partners has just announced that it will acquire Gregson & Weight Funeral Directors, which has been operating in the Sunshine Coast since the 1970s. Gregson & Weight conducts 1650 funerals annually and produces revenue of $12 million. They provide funeral directing services from four locations: Caloundra, Buderim, Nambour, and Noosaville. Gregson & Weight also operates cremators at three of those sites, being Caloundra, Nambour, and Noosaville.

Who is Propel Funeral Partners?

Propel Funeral Partners is a Sydney-based publicly listed company which operates in the death care industry in Australia and New Zealand. It owns funeral director companies, along with cemeteries, crematoria and related assets. Propel operates from 120 locations, including 28 cremation facilities and 9 cemeteries.

The company listed on the Australian Stock Exchange in late November 2017 and own funeral homes, cemeteries, crematoria and related assets in Queensland, New South Wales, Victoria, Tasmania, South Australia, Western Australia and New Zealand

Should Independent Funeral Homes be concerned?

Although the ACCC has determined it will not oppose the acquisition of Gregson & Weight by Propel Funeral Partners, there are broader concerns from market participants. The ACCC has noted that ”consumers can be particularly vulnerable” and the regulator says it will be keeping an even closer eye on consolidation in the funeral industry as buyouts of smaller operators by big players continue.

According to ACCC Commissioner Stephen Ridgeway, “The proposed acquisition would be unlikely to result in a substantial reduction in competition in the supply of funeral director services in the Sunshine Coast region. “Propel and Gregson & Weight predominantly focus on different customer segments and there is limited current competition between them,” he said.

“Gregson & Weight currently has the majority of the market and is the clear market leader in the Sunshine Coast region, while Propel has a small presence. We don’t believe the market will be significantly altered as a result of the acquisition.”

Why is this bad news for consumers?

The funeral industry in Australia is currently estimated to be $1.5 billion and is currently dominated by two ASX listed companies, InvoCare and Propel Funeral Partners.

Peter Erceg, Founder of eziFunerals said, “This latest acquisition by Propel Funeral Partners may be good news for shareholders, but not for grieving families”. “InvoCare and Propel Funeral Partners continue to increase their footprint and buy out small operators to increase their market share, at the expense of consumers”, he said.

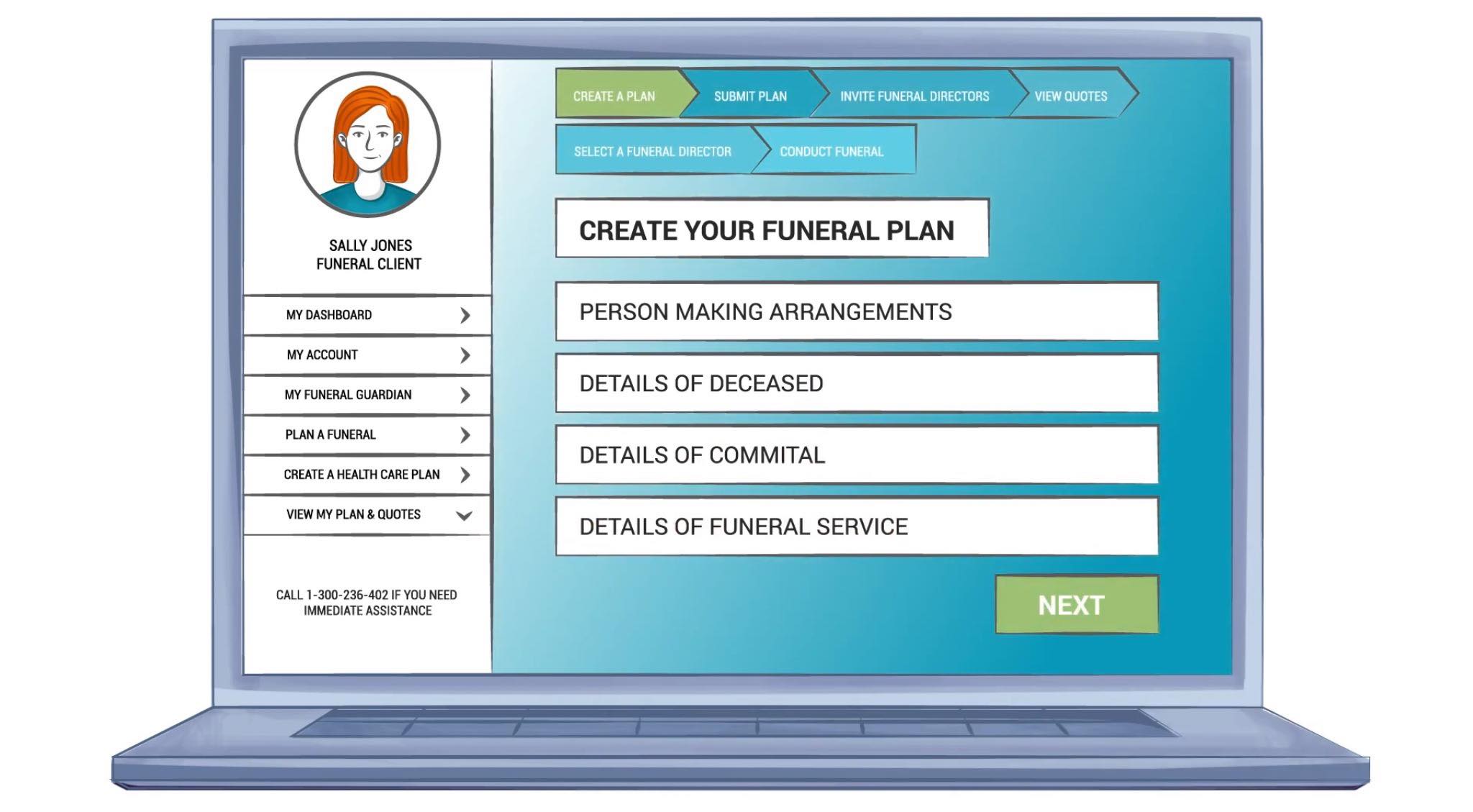

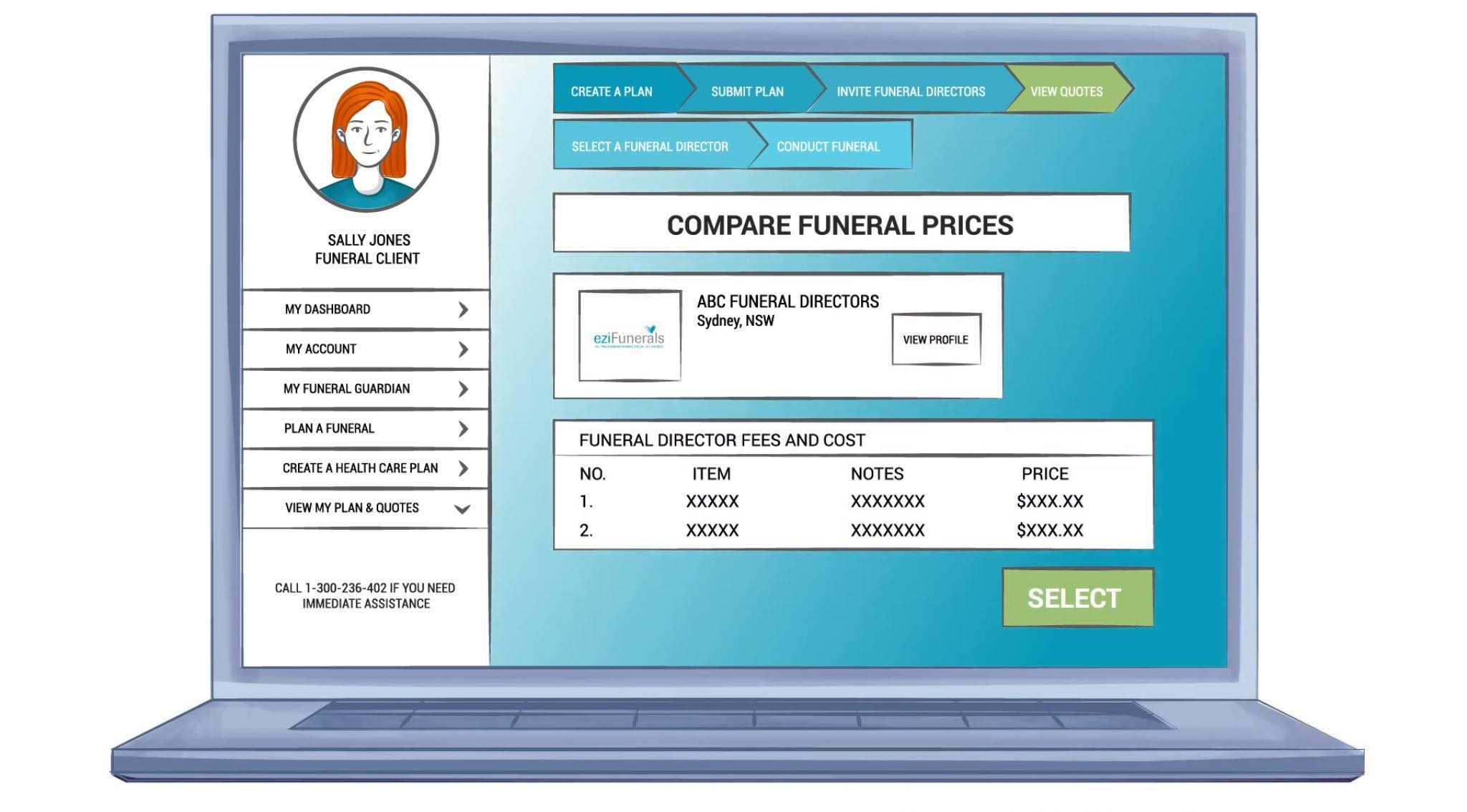

According to eziFunerals, “unless consumers know who owns their local funeral home and shop around, they will continue to hit with rising costs and a lack of choice. This is not in the interests of grieving families and family owned funeral homes”.

Learn more about death and funerals in Australia

About eziFunerals

eziFunerals supports individuals and families cope with end of life decisions, death and funerals. We are an independent, Australian-owned and operated company, and are not a subsidiary of any other corporation. We are not part of any other funeral company.